Today by far the deadliest weapon of mass destruction in Washington’s arsenal lies not with the Pentagon or its traditional killing machines. It’s de facto a silent weapon: the ability of Washington to control the global supply of money, of dollars, through actions of the privately-owned Federal Reserve in coordination with the US Treasury and select Wall Street financial groups. Developed over a period of decades since the decoupling of the dollar from gold by Nixon in August, 1971, today control of the dollar is a financial weapon that few if any rival nations are prepared to withstand, at least not yet.

Ten years ago, in September, 2008, US Treasury Secretary, former Wall Street banker Henry Paulson, deliberately pulled the plug on the global dollar system by allowing the mid-sized Wall Street investment bank, Lehman Bros go under. At that point, with aid of the infinite money-creating resources of the Fed known as Quantitative Easing, the half-dozen top banks of Wall Street, including Paulson’s own Goldman Sachs, were rescued from a debacle their exotic securitized finance created. The Fed also acted to give unprecedented hundreds of billions of US dollar credit lines to EU central banks to avert a dollar shortage that would clearly have brought the entire global financial architecture crashing down. At the time six Eurozone banks had dollar liabilities in excess of 100% of their country GDP.

A World Full of Dollars

Since that time a decade ago, the supply of cheap dollars to the global financial system has risen to unprecedented levels. The Institute for International Finance in Washington estimates the debt of households, governments, corporations and the financial sector in the 30 largest emerging markets rose to 211% of gross domestic product at the start of this year. It was 143% at the end of 2008.

Further data from the Washington IIF indicate the scale of a debt trap that is only in early stages of detonating across the less-advanced economies from Latin America to Turkey to Asia. Excluding China, emerging market total debt, in all currencies including domestic, has nearly doubled from 15 trillion dollars in 2007 to 27 trillion dollars at end of 2017. China debt in the same time went from 6 trillion dollars to 36 trillion dollars according to IIF. For the group of Emerging Market countries, their debts denominated in US dollars has grown to some 6.4 trillion dollars from 2.8 trillion dollars in 2007. Turkish companies now owe almost 300 billion dollars in foreign-denominated debt, over half its GDP, most in dollars. Emerging markets preferred the dollar for many reasons.

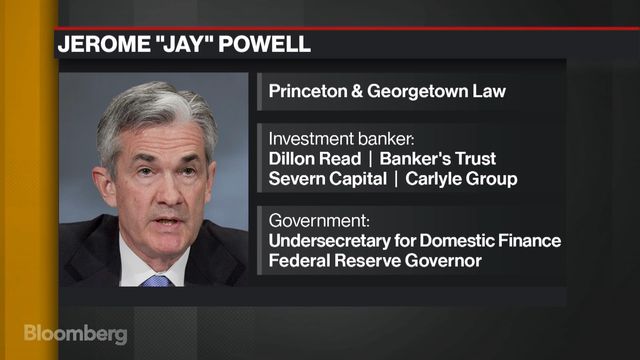

As long as those emerging economies were growing, earning export dollars at a rising rate, the debt was manageable. Now all that’s beginning to change. The agent of that change is the world’s most political central bank, the US Federal Reserve, whose new chairman, Jerome Powell, is a former partner of the spooky Carlyle Group. Arguing that the domestic US economy is strong enough that they can return US dollar interest rates to “normal,” the Fed has begun a titanic shift in dollar liquidity to the world economy. Powell and the Fed know very well what they are doing. They are ratcheting up the dollar screws to precipitate a major new economic crisis across the emerging world, most especially from key Eurasian economies such as Iran, Turkey, Russia and China.

Despite all efforts of Russia, China, Iran and other countries to shift away from US dollar dependence for international trade and finance, the dollar remains still unchallenged as world central bank reserve currency, some 63% of all BIS central bank reserves. Moreover almost 88% of daily foreign currency trades are in US dollars. Most all oil trade, gold and commodity trades are denominated in dollars. Since the Greek crisis in 2011 the Euro has not been a serious rival for reserve currency hegemony. Its share in reserves are about 20% today.

Since the 2008 financial crisis the dollar and the importance of the Fed have expanded to unprecedented levels. This is only now beginning to be appreciated as the world begins to feel for the first time since 2008 real dollar shortages, meaning a much higher cost to borrow more dollars to refinance old dollar debt. The peak for total emerging market dollar debt falling due comes in 2019, with more than 1.3 trillion dollars maturing.

Here comes the trap. The Fed is not only hinting it will raise US Fed funds rates more aggressively later this year into next. It is also reducing the amount of US Treasury debt it bought after the 2008 crisis, so-called QT or Quantitative Tightening.

From QE to QT…

After 2008 the Fed began what was called Quantitative Easing. The Fedbought a staggering sum of bonds from the banks up to a peak of 4.5 trillion dollars from only 900 billion dollars at the start of the crisis. Now the Fed announces it plans to reduce that by at least one third in coming months.

The result of QE was that the major banks behind the 2008 financial crisis were flooded with liquidity from the Fed and interest rates plunged to zero. That bank liquidity was in turn invested in any part of the world offering higher returns as US bonds paid near zero interest. It went into junk bonds in the shale oil sector, into a new US housing mini boom. Most markedly the liquid dollars went into higher-risk emerging markets like Turkey, Brazil, Argentina, Indonesia, India. Dollars flooded into China where the economy was booming. And the dollars poured into Russia before US sanctions earlier this year began to put a chill on foreign investors.

Now the Fed has begun QT – Quantitative Tightening – the reverse of QE. Late 2017 the Fed slowly began to shrink its bond holdings which reduces dollar liquidity in the banking system. In late 2014 the Fed already stopped buying new bonds from the market. The reduction of the bond holdings of the Fed in turn pushed interest rates higher. Until this summer, it was all “gently, gently.” Then the US President launched a global targeted trade war offensive, creating huge uncertainty in China, Latin America, Turkey and beyond, and new economic sanctions on Russia and Iran.

Today the Fed is allowing 40 billion dollars of its Treasury and corporate bonds mature without replacing them, rising to 50 billion dollars monthly later this year. That takes those dollars out of the banking system. In addition, to aggravate what is quickly becoming a full-blown dollar shortage, the Trump tax cut law is adding hundreds of billions to the deficit that the US Treasury will have to finance by issuing new bond debt. As the supply of US Treasury debt rises, the Treasury will be forced to pay higher interest to sell those bonds. Higher US interest rates already are acting as a magnet to suck dollars back into the US from around the world.

Adding to the global tightening, under pressure from the dominance of the Fed and the dollar, the Bank of Japan and the European Central Bank have been forced to announce they would no longer buy bonds in their respective QE actions. Since March, the world has de facto been in the new era of QT.

From here it looks to get dramatic unless the Federal Reserve does an about face and resumes with a new QE liquidity operation to avoid a global systemic crisis. At this juncture that looks unlikely. Today the world central banks more than even before 2008, dance to the tune played by the Federal Reserve. As Henry Kissinger allegedly stated in the 1970’s “If you control the money, you control the world.”

A 2019 New Global Crisis?

While so far the impact of dollar contraction has been gradual, it’s about to get dramatic. The combined G-3 central banks’ balance sheet increased by a mere 76 billion dollars in the first half of 2018, compared with a 703 billion dollars rise in the prior six months – almost half a trillion of dollars gone from the global lending pool. Bloomberg estimates that net asset purchases by the three main central banks will fall to zero by the end of this year, from close to 100 billion dollars a month at the end of 2017. Annually that translates into an equivalent 1.2 trillion dollars less of dollar liquidity in 2019 in the world.

The Turkish Lira has dropped by half since early this year in relation to the US dollar. That means Turkish large construction companies and others who were able to borrow “cheap” dollars, now must find double the sum of US dollars to service those debts. The debt is not state Turkish debt for the most part but private corporate borrowing. Turkish companies owe an estimated 300 billion dollars in foreign currency debt, most dollars, almost half the entire GDP of the country. That dollar liquidity has kept the Turkish economy growing since the 2008 US financial crisis. Not only the Turkish economy…Asian countries from Pakistan to South Korea, minus China, have borrowed an estimated 2.1 trillion dollars.

As long as the dollar depreciated against those currencies and the Fed kept interest rates low – as from 2008 – 2015, there was little problem. Now that’s all changing and dramatically so. The dollar is rising strongly against all other currencies, 7% this year. Combined with this, Washington is deliberately initiating trade wars, political provocations, unilateral breaking of the Iran treaty, new sanctions on Russia, Iran, North Korea, Venezuela, and unprecedented provocations against China. Trump’s trade wars, ironically, have led to a “flight to safety” out of emerging countries like Turkey or China to the US markets, most notably the stock market.

The Fed is weaponizing the US dollar and the preconditions are in many ways similar to that during the 1997 Asia crisis. Then all it needed was a concerted US hedge fund attack on the weakest Asian Tier economy, the Thai Baht to trigger collapse across most of South Asia to South Korea and even Hong Kong. Today the trigger is Trump and his bellicose tweets against Erdogan.

The US Trump trade wars, political sanctions and new tax laws, in the context of the clear Fed strategy of dollar tightening, provide the backdrop to wage a dollar war against key political opponents globally without ever having to declare war. All it took was a series of trade provocations against the huge China economy, political provocations against the Turkish government, new groundless sanctions against Russia, and banks from Paris to Milan to Frankfurt to New York and anyone else with dollar loans to higher risk emerging markets began the rush for the exit. The Lira collapses as a result of near panic selling, or the Iran currency crisis, the fall of the Russian ruble. All reflects the beginning, as likely does the decline in the China Renminbi, of a global dollar shortage.

If Washington succeeds on November 4 in cutting all Iran oil exports, world (dollar) oil prices could soar above 100 dollars, adding dramatically to the developing world dollar shortage. This is war by other means. The Fed dollar strategy is acting now as a “silent weapon” for not so quiet wars. If it continues it could deal a serious setback to the growing independence of Eurasian countries around the China New Silk Road and the Russia-China-Iran alternative to the dollar system. The role of the dollar as lead global reserve currency and the ability of the Federal Reserve to control it, is a weapon of massive destruction and a strategic pillar of American superpower control. Are the nations of Eurasia or even the ECB ready to deal effectively?

William Engdahlis strategic risk consultant and lecturer, he holds a degree in politics from Princeton University and is a best-selling author on oil and geopolitics, exclusively for the online magazine “New Eastern Outlook”.

Original source: New Eastern Outlook