As Republican and democrat politicians hold emergency meetings to decide how to avoid a meltdown of Wall Street, the smell of hyperinflation looms in the air as much today as it did in Germany during the opening months of 1922. This week, markets were propped up by a record breaking offering of $1.5 Trillion in liquidity injections over the coming months (added to the $9 trillion already injected over the past six months), and rather than deal with the real reasons for this oncoming financial collapse, the media has brainwashed the west that everything would have been just fine, “if only coronavirus had not become a pandemic”.

But what is really being bailed out here exactly and why? Is this money actually making it to the real economy? Is it being invested to rebuild America’s farms, businesses and industry?

The reality is that the only thing being saved are the “Too Big to Fail” banks that are sitting atop a $1.5 quadrillion of derivatives bomb. Of the most bankrupt of America’s speculators are JPMorgan Chase, Citigroup and Goldman Sachs, whose derivatives exposure hit $48 trillion, $47 trillion and $42 trillion respectively in recent years.

It is my contention that Trump is genuine in his desire to “drain the swamp” and rebuild America’s lost industrial base. I also genuinely believe that Trump wishes to establish positive relations with Russia, China and other sovereign nation states which has drawn the ire of the international deep state. However Trump’s potentially fatal blind spot appears to be his tendency to believe the lie that Wall Street’s wellbeing is somehow indicative of America’s wellbeing.

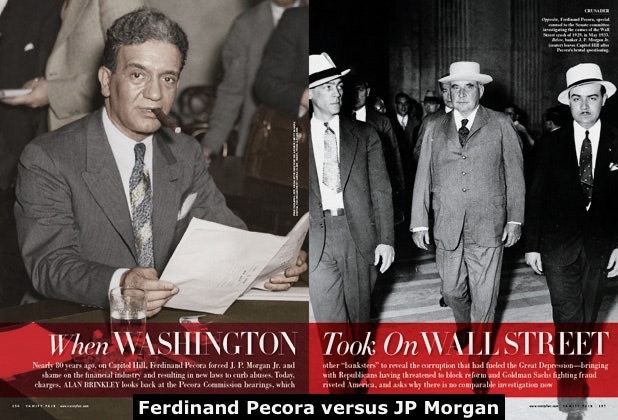

If Trump is intelligent, (and his previous calls for Glass-Steagall’s restoration, and American System practices imply that he knows a thing or two), then rather than bailing out Wall Street by unleashing more gasoline onto the fire, it were better that he took the lessons of 1933 and established a new Pecora Commission for 2020.

What was the Pecora Commission?

Many are aware of the economic meltdown of October 24,1929 that ushered in four years of depression onto America (and much of the western world). However not many people are aware of the intense fight that was launched by patriots in both parties against the Wall Street/deep state parasite of that age which prevented both a fascist coup against the newly elected Franklin Roosevelt while also crippling Wall Street’s command of American life. In spite of whitewashing revisionist history books that contaminated the past 70 years, America’s recovery from the depression never occurred without a life or death struggle and this struggle was made possible, in large measure by the courageous work of an Italian lawyer from New York. This man’s name was Ferdinand Pecora.

By 1932, when Senators Peter Norbeck (R-SD) and George Norris (R-NB) spearheaded the establishment of the U.S. Committee on Banking and Currency, the American economy was on life support and the people were so desperate that a fascist dictatorship in America would have been welcomed with open arms if only bread could be put on the table. Unemployment had reached 25%, while over 40% of banks had gone bankrupt and 25% of the population had lost their savings. Thousands of tent cities called ‘Hoovervilles’ were spread across the USA and over 50% of America’s industrial capacity had shut down. Thousands of farms had been foreclosed and the engines of American industry had grinded to a screeching halt.

Across the ocean, the fascist regimes of Germany, Italy and Spain were growing more powerful by the day fed by injections of hundreds of millions of dollars of capital by London and Wall Street bankers. Notable among these pro-fascist financiers was none other than Bush family patriarch Prescott, who provided millions in loans to Hitler’s bankrupt Nazi party in 1932 (and continued doing business with the party through 1942- having only stopped after being found guilty for “trading with the enemy”).

The Committee on Banking and Currency was a relatively impotent body when it began in 1932, but when Senator Norbeck called in Ferdinand Pecora to lead it in April 1932, everything began to change. A first generation Italian-American, Pecora was forced to quit high school after his father was injured in order to support his family. Years later, the young man found work as a clerk in a law firm, and managed to work his way through law school, passing the bar in 1911. His unimpeachable reputation earned him the animosity of powerful NY financiers who ensured that his successes in prosecuting brokers never resulted in attaining Attorney General, where he made a name for himself shutting down over 100 illegal brokerage houses that speculated on fraudulent securities during the depression.

Within days of accepting the Washington job as Chief Council of Norbeck’s committee (for the meager salary of $250/month), Pecora was granted broad subpoena powers to audit banks and drag the most powerful men in America to testify in the committee’s hearings.

In his first two weeks, Pecora made headlines by auditing the books of major Wall Street banks and pulled in pro-fascist National City President Charles Mitchell (then preparing to advise Benito Mussolini) to testify. Within days, Mitchell’s team of expensive defense attorneys could do nothing but watch in despair as the powerful financier admitted to short selling his own bank’s stocks during the depression, scamming depositors with purchases of Cuban junk debt and avoiding taxes for years. Mitchell was forced to resign in shame followed days later by NY Stock Exchange Chair Dick Whitney- who left the court in handcuffs.

This crackdown on Wall Street’s abuses were highly publicized and put the spotlight on the criminal schemes used to gamble with savings and commercial bank deposits on securities and futures markets which led to the orchestrated collapse of the bubble economy in 1929 (ironically much of the bubble built up during the “easy-money days” of the “roaring 20s” was centered in the housing market). Pecora’s crackdown also set the tone for the incoming Roosevelt administration.

Unlike the previous 1911 Pujo Commission led by Senator Charles Lindberg Sr. which also exposed Wall Street’s abuses of power, the Pecora Commission was supported by a President who actually cared about the Constitution and amplified Pecora’s powers even further. When FDR was told that supporting Pecora’s exposures of financial crimes would hurt the economy, the President famously responded with “they should have thought of that when they did the things that are being exposed now.” FDR followed up that warning by encouraging the attorney to take on John Pierpont Morgan Jr.

Rather than controlling an American institution as many believed 70 years ago and today, J.P. Morgan Jr. was actually running an operation that had earlier been created in the mid-19th century as part of a British infiltration of America. As historian John Hoefle pointed out in a 2009 EIR study:

“The House of Morgan was, in truth, a British operation from its inception. It began life as George Peabody & Co., a bank founded in London in 1851 by American George Peabody. A few years later, another American, Junius S. Morgan, joined the firm, and upon Peabody’s death the firm became J.S. Morgan & Co. Junius Morgan brought in his son, J. Pierpont Morgan, to head the New York office of J.S. Morgan, and the New York office became J.P. Morgan & Co. From its original role in helping the British gain control of American railroads, the Morgan bank became a leading force in the oligarchy’s war against the American System, using the deep pockets of its imperial masters to become a powerhouse in not only finance but steel, automobiles, railroads, electricity generation, and other industries.”

By 1933, the House of Morgan grew into a multi-headed hydra controlling utilities, holding companies, banks and countless other subsidiaries.

When J.P. Morgan jr. was called to testify, the banker carried a midget on his lap in mockery of the “circus of the commission”. As the questions began however, the arrogant banker was caught off guard by Pecora’s proof of Morgan’s secret “preferred clients lists” of politicians whom the banker owned and who received stock offerings at discount rates. Named among the thousands of traitors on this list, Pecora revealed former president Calvin Coolidge, Coolidge’s Treasury Secretary Andrew Mellon (a Schacht-Hitler supporter from the start), financier Bernard Baruch, Supreme Court Justice Owen Roberts and Democratic Party controller John Jacob Raskob. Raskob was not only a major speculator but was also the leader of the American Liberty League which tried repeatedly to overthrow FDR between 1933-1939 and worked to ally America with axis powers from 1939-1941.

Morgan’s god-like ego was brought down to the level of mortals when the flustered banker was only able to answer “I can’t remember” repeatedly when asked if he had paid taxes over the past 5 years. As it turned out, by the end of the trial, it was revealed that NONE of the subsidiaries of the House of Morgan paid any taxes during the entire period of the depression, and were caught gambling with depositors assets from commercial accounts. These revelations didn’t sit well with a population dying of starvation across the streets of America.

Similar displays of corruption were made of the heads of Kohn Loeb, Chase Bank, Brown Brothers Harriman and others.

Faced with these revelations, The Nation magazine famously reported “If you steel $25, you’re a thief. If you steal $250 000, you’re an embezzler. If you steal $2.5 million, you’re a financier.”

Pecora’s ally Sen. Burton Wheeler said “the best way to restore confidence in our banks is to take these crooked presidents out of the banks and treat them the same as we treated Al Capone.”

FDR Drains the Swamp

With the light cast firmly upon the dark shadows where vile creatures like J.P. Morgan and other financial gremlins reside, the population was finally able to start making sense of what injustices befell them during the years of post-1929 despair. While not every banker went to prison as Wheeler or Pecora would have liked, examples were made of dozens who did and many more whose careers were shamefully ended. Most importantly however, this exposure gave Franklin Roosevelt the support needed to drain the swamp and impose sweeping reforms upon the banks.

In the first hundred days, FDR was able to:

1) Impose Glass-Steagall banking separation (forcing Wall Street banks to break up their functions and preventing speculators from gambling with productive assets)

2) Create the Federal Deposit Insurance Corporation (FDIC) that protected citizens’ savings from future crises

3) Create the Securities Exchange Commission to provide oversight to Wall Street’s activities and on whose body Pecora was appointed commissioner in 1934.

4) Unleash broad credit through the Reconstruction Finance Corporation (RFC) which acted as a national bank bypassing the private Federal Reserve, channeling $33 billion to the real economy by 1945 (more than all private commercial banks combined)

5) Impose protective tariffs on agriculture, metals and industrial goods to stop dumping of cheap products in America and rebuild America’s physical economy

6) Create vast public works, like the Tennessee Valley Authority, Grand Coulee dams, Hoover dams, St Laurence development and countless other projects, hospitals, schools, bridges, roads and rail under the New Deal that acted in many ways then as China’s Belt and Road Initiative has in our modern age. Unfortunately, Roosevelt died before this new form of political economy could be internationalized abroad in the post-war years as an anti-colonial program.

A beautiful outline of FDR’s struggle is showcased in the 2008 film ‘1932: Speak not of Parties but of Universal Principles’.

Embed: https://www.youtube.com/watch?v=V–oozjFwo4

Subverting a Fascist Coup Then and Now

Ferdinand Pecora’s Commission shaped the dynamics of America so intensely by its simple power of speaking the truth, that efforts to run a fascist coup against FDR using a general named Smedley Butler also came undone before it could succeed. Butler played along with Wall Street’s plans for some months before deciding to publicly blow the whistle in congress. Butler exposed the intension to use him as a “puppet dictator” leading thousands of American legionnaires in a storming of the White House displacing FDR.

It is often forgotten today, but in the early days of the 1920s-1930s, the Legion was modeled on Mussolini’s fascist squadristi and even its leader Alvin Owsley made explicit in 1921 saying:

“If need be the American Legion is ready to protect the institutions of this country and its ideals, in the same way as the Fascists have treated the destructive forces threatening Italy. Don’t forget that the Fascists are for today’s Italy what the American Legion is for the United States.”

Butler’s startling revelations amplified FDR’s popular support and inoculated much of the population from the fake news pouring out of Wall Street propaganda agencies spread across the media.

In 1939, Pecora wrote a book called ‘Wall Street Under Oath: The Story of our Modern Money Changers’ where the attorney prophetically said:

“Under the surface of the governmental regulation of the securities market, the same forces that produced the riotous speculative excesses of the ‘wild bull market’ of 1929 still give evidence of their existence and influence. Though repressed for the present, it cannot be doubted that, given a suitable opportunity, they would spring back to their pernicious activity.”

Pecora went onto deliver one more warning which current generations should take seriously “Had there been full disclosure of what has been done in furtherance of these schemes, they could not long have survived the fierce light of publicity and criticism. Legal chicanery and pitch darkness were the bankers’ stoutest allies.”

Today’s oncoming economic meltdown can only be prevented if the lessons of 1933 are taken seriously and patriots who actually care about their nations and people stop legitimizing the casino economy of fictitious capital, derivatives, debt slavery and anti-humanism that has become so commonplace across the governing strata of the technocratic and banking elite today trying to control the world. This elite, just like the financiers of the 1920s, doesn’t care ultimately for money as an end but sees it merely as a means for imposing fascist forms of governance onto the world population. In the same way that FDR’s Wall Street/London enemies sought a world government under Nazi enforcers then, today’s heirs to that anti-human legacy are driven by a religious-like commitment to “manage” a new collapse of world civilization under a Green New Deal and World Government.

So why accept that dystopic future when a brighter one is offered us by the Multipolar alliance today led by Russia and China?

Source: Strategic Culture Foundation